Markets

All of the World’s Money and Markets in One Visualization

All of the World’s Money and Markets in One Visualization

In the current economic circumstances, there are some pretty large numbers being thrown around by both governments and the financial media.

The U.S. budget deficit this year, for example, is projected to hit $3.8 trillion, which would be more than double the previous record set during the financial crisis ($1.41 trillion in FY2009). Meanwhile, the Fed has announced “open-ended” asset-buying programs to support the economy, which will add even more to its current $7 trillion balance sheet.

Given the scale of these new numbers—how can we relate them back to the more conventional numbers and figures that we may be more familiar with?

Introducing the $100 Billion Square

In the above data visualization, we even the playing field by using a common denominator to put the world’s money and markets all on the same scale and canvas.

Each black square on the chart is worth $100 billion, and is not a number to be trifled with:

In fact, the entire annual GDP of Cuba could fit in one square ($97 billion), and the Greek economy would be roughly two squares ($203 billion).

Alternatively, if you’re contrasting this unit to numbers found within Corporate America, there are useful comparisons there as well. For example, the annual revenues of Wells Fargo ($103.9 billion) would just exceed one square, while Facebook’s would squeeze in with room to spare ($70.7 billion).

Billions, Trillions, or Quadrillions?

Here’s our full list, which sums up all of the world’s money and markets, from the smallest to the biggest, along with sources used:

| Category | Value ($ Billions, USD) | Source |

|---|---|---|

| Silver | $44 | World Silver Survey 2019 |

| Cryptocurrencies | $244 | CoinMarketCap |

| Global Military Spending | $1,782 | World Bank |

| U.S. Federal Deficit (FY 2020) | $3,800 | U.S. CBO (Projected, as of April 2020) |

| Coins & Bank Notes | $6,662 | BIS |

| Fed's Balance Sheet | $7,037 | U.S. Federal Reserve |

| The World's Billionaires | $8,000 | Forbes |

| Gold | $10,891 | World Gold Council (2020) |

| The Fortune 500 | $22,600 | Fortune 500 (2019 list) |

| Stock Markets | $89,475 | WFE (April 2020) |

| Narrow Money Supply | $35,183 | CIA Factbook |

| Broad Money Supply | $95,698 | CIA Factbook |

| Global Debt | $252,600 | IIF Debt Monitor |

| Global Real Estate | $280,600 | Savills Global Research (2018 est.) |

| Global Wealth | $360,603 | Credit Suisse |

| Derivatives (Market Value) | $11,600 | BIS (Dec 2019) |

| Derivatives (Notional Value) | $558,500 | BIS (Dec 2019) |

| Derivatives (Notional Value - High end) | $1,000,000 | Various sources (Unofficial) |

Derivatives top the list, estimated at $1 quadrillion or more in notional value according to a variety of unofficial sources.

However, it’s worth mentioning that because of their non-tangible nature, the value of financial derivatives are measured in two very different ways. Notional value represents the position or obligation of the contract (i.e. a call to buy 100 shares at the price of $50 per share), while gross market value measures the price of the derivative security itself (i.e. $1.00 per call option, multiplied by 100 shares).

It’s a subtle difference that manifests itself in a big way numerically.

Correction: Graphic updated to reflect the average value of an NBA team.

United States

Ranked: The Top 6 Economies by Share of Global GDP (1980-2024)

Gain a unique perspective on the world’s economic order from this graphic showing % share of global GDP over time.

Top 6 Economies by Share of Global GDP (1980-2024)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Over time, the distribution of global GDP among the world’s largest economies has shifted dynamically, reflecting changes in economic policies, technological advancements, and demographic trends.

To see how this has played out in recent decades, we visualized the world’s top six economies by their share of global GDP from 1980 to 2024.

All figures were sourced from the IMF’s World Economic Outlook (April 2024 edition) and are based on using current prices.

Data and Highlights

The data we used to create this graphic can be found in the table below.

| Share of Global GDP (%) | U.S. | EU | China | Japan | UK | India |

|---|---|---|---|---|---|---|

| 1980 | 25.4% | 28.6% | 2.7% | 10.1% | 5.4% | 1.7% |

| 1981 | 27.8% | 24.7% | 2.5% | 10.8% | 5.1% | 1.7% |

| 1982 | 29.6% | 24.4% | 2.5% | 10.2% | 4.9% | 1.8% |

| 1983 | 31.3% | 23.2% | 2.6% | 10.9% | 4.6% | 1.9% |

| 1984 | 33.6% | 21.6% | 2.6% | 11.2% | 4.2% | 1.8% |

| 1985 | 34.6% | 21.3% | 2.5% | 11.4% | 4.3% | 1.9% |

| 1986 | 31.0% | 24.7% | 2.0% | 14.3% | 4.4% | 1.7% |

| 1987 | 28.5% | 26.3% | 1.9% | 15.2% | 4.8% | 1.6% |

| 1988 | 27.3% | 25.9% | 2.1% | 16.3% | 5.2% | 1.5% |

| 1989 | 28.0% | 25.0% | 2.3% | 15.4% | 5.0% | 1.5% |

| 1990 | 26.3% | 27.4% | 1.8% | 14.1% | 5.3% | 1.4% |

| 1991 | 26.0% | 28.0% | 1.7% | 15.4% | 5.3% | 1.1% |

| 1992 | 25.7% | 28.8% | 1.9% | 15.7% | 5.1% | 1.1% |

| 1993 | 26.3% | 25.6% | 2.4% | 17.4% | 4.4% | 1.1% |

| 1994 | 26.0% | 25.3% | 2.0% | 17.8% | 4.4% | 1.2% |

| 1995 | 24.5% | 26.5% | 2.3% | 17.8% | 4.3% | 1.2% |

| 1996 | 25.1% | 26.2% | 2.7% | 15.3% | 4.4% | 1.2% |

| 1997 | 26.8% | 24.1% | 3.0% | 14.0% | 4.9% | 1.3% |

| 1998 | 28.4% | 25.0% | 3.2% | 12.9% | 5.2% | 1.3% |

| 1999 | 29.2% | 24.0% | 3.3% | 14.0% | 5.1% | 1.4% |

| 2000 | 30.1% | 21.3% | 3.5% | 14.6% | 4.9% | 1.4% |

| 2001 | 31.3% | 21.8% | 3.9% | 12.9% | 4.9% | 1.4% |

| 2002 | 31.3% | 23.1% | 4.2% | 12.0% | 5.1% | 1.5% |

| 2003 | 29.2% | 25.3% | 4.2% | 11.5% | 5.2% | 1.5% |

| 2004 | 27.7% | 25.8% | 4.4% | 11.1% | 5.5% | 1.6% |

| 2005 | 27.2% | 24.9% | 4.8% | 10.1% | 5.3% | 1.7% |

| 2006 | 26.7% | 24.5% | 5.3% | 8.9% | 5.2% | 1.8% |

| 2007 | 24.7% | 25.2% | 6.1% | 7.8% | 5.3% | 2.1% |

| 2008 | 23.0% | 25.4% | 7.1% | 8.0% | 4.6% | 1.9% |

| 2009 | 23.8% | 24.3% | 8.4% | 8.7% | 4.0% | 2.2% |

| 2010 | 22.6% | 21.9% | 9.1% | 8.7% | 3.7% | 2.5% |

| 2011 | 21.1% | 21.3% | 10.1% | 8.4% | 3.6% | 2.5% |

| 2012 | 21.6% | 19.5% | 11.3% | 8.3% | 3.6% | 2.4% |

| 2013 | 21.8% | 19.7% | 12.4% | 6.7% | 3.6% | 2.4% |

| 2014 | 22.1% | 19.7% | 13.2% | 6.2% | 3.9% | 2.6% |

| 2015 | 24.4% | 18.0% | 14.8% | 5.9% | 3.9% | 2.8% |

| 2016 | 24.6% | 18.2% | 14.7% | 6.5% | 3.5% | 3.0% |

| 2017 | 24.1% | 18.2% | 15.1% | 6.1% | 3.3% | 3.3% |

| 2018 | 24.0% | 18.5% | 16.0% | 5.8% | 3.3% | 3.1% |

| 2019 | 24.6% | 17.9% | 16.4% | 5.8% | 3.3% | 3.2% |

| 2020 | 25.0% | 18.0% | 17.4% | 5.9% | 3.2% | 3.1% |

| 2021 | 24.3% | 17.9% | 18.3% | 5.2% | 3.2% | 3.3% |

| 2022 | 25.6% | 16.7% | 17.7% | 4.2% | 3.1% | 3.3% |

| 2023 | 26.1% | 17.5% | 16.9% | 4.0% | 3.2% | 3.4% |

| 2024E | 26.3% | 17.3% | 16.9% | 3.8% | 3.2% | 3.6% |

U.S. Resilience

Starting with the U.S., we can see that America’s share of global GDP has fluctuated quite significantly over time.

After bottoming out at 21.1% in 2011, the U.S. economy grew its relative size by several percentage points, and is estimated by the IMF to make up 26.3% of global GDP in 2024.

This chart also suggests that the U.S. has managed a stronger recovery from the COVID-19 pandemic, evidenced by its rising share of global GDP since 2020. China, the EU, and Japan have seen relative declines over the same period.

China’s Incredible Rise

This chart also provides perspective on China’s period of rapid economic growth, which began in the early 2000s.

It’s interesting to note that China joined the World Trade Organization (WTO) in 2001, which facilitated China’s integration into the global economy.

Japan Falls From the #2 Spot

Japan was once the second largest country economy after the U.S., accounting for 17.8% of the global economy in 1994 and 1995. Since then, economic stagnation and an aging population have resulted in a relative decline of the country’s economic might.

See More Global Economic Insights From Visual Capitalist

If you enjoyed this post, be sure to check out Ranked: The Top Economies in the World (1980-2075), which shows how China and India could eventually surpass the U.S. as the world’s biggest economies.

-

Personal Finance6 days ago

Personal Finance6 days agoVisualizing the Tax Burden of Every U.S. State

-

Economy2 weeks ago

Economy2 weeks agoThe Most Valuable Companies in Major EU Economies

-

Markets2 weeks ago

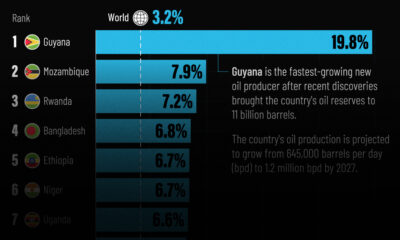

Markets2 weeks agoThe World’s Fastest Growing Emerging Markets (2024-2029 Forecast)

-

Markets2 weeks ago

Markets2 weeks agoVisualizing Global Inflation Forecasts (2024-2026)

-

Politics2 weeks ago

Politics2 weeks agoCharted: What Southeast Asia Thinks About China & the U.S.

-

Misc1 week ago

Misc1 week agoThe Evolution of U.S. Beer Logos

-

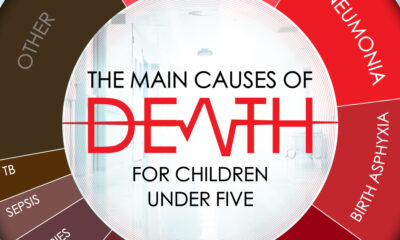

Healthcare1 week ago

Healthcare1 week agoWhat Causes Preventable Child Deaths?

-

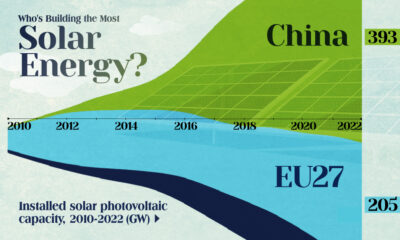

Energy1 week ago

Energy1 week agoWho’s Building the Most Solar Energy?