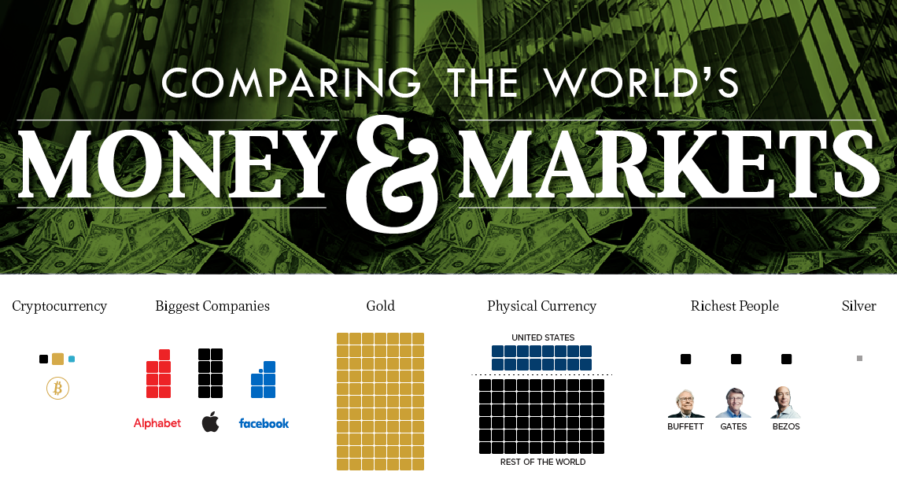

All of the World’s Money and Markets in One Visualization

Enjoy this graphic? You can also find it in our new infographic book – it’s available until Oct 31st, 2017 on Kickstarter.

Millions, billions, and trillions…

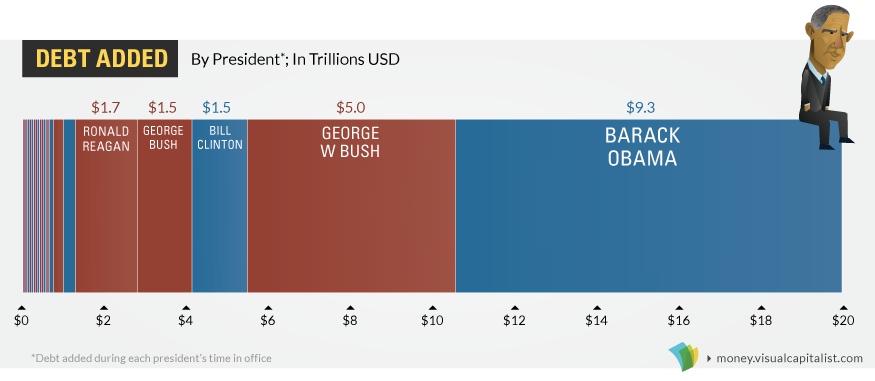

When we talk about the giant size of Apple, the fortune of Warren Buffett, or the massive amount of global debt accumulated – all of these things sound large, but they are actually extremely different in magnitude.

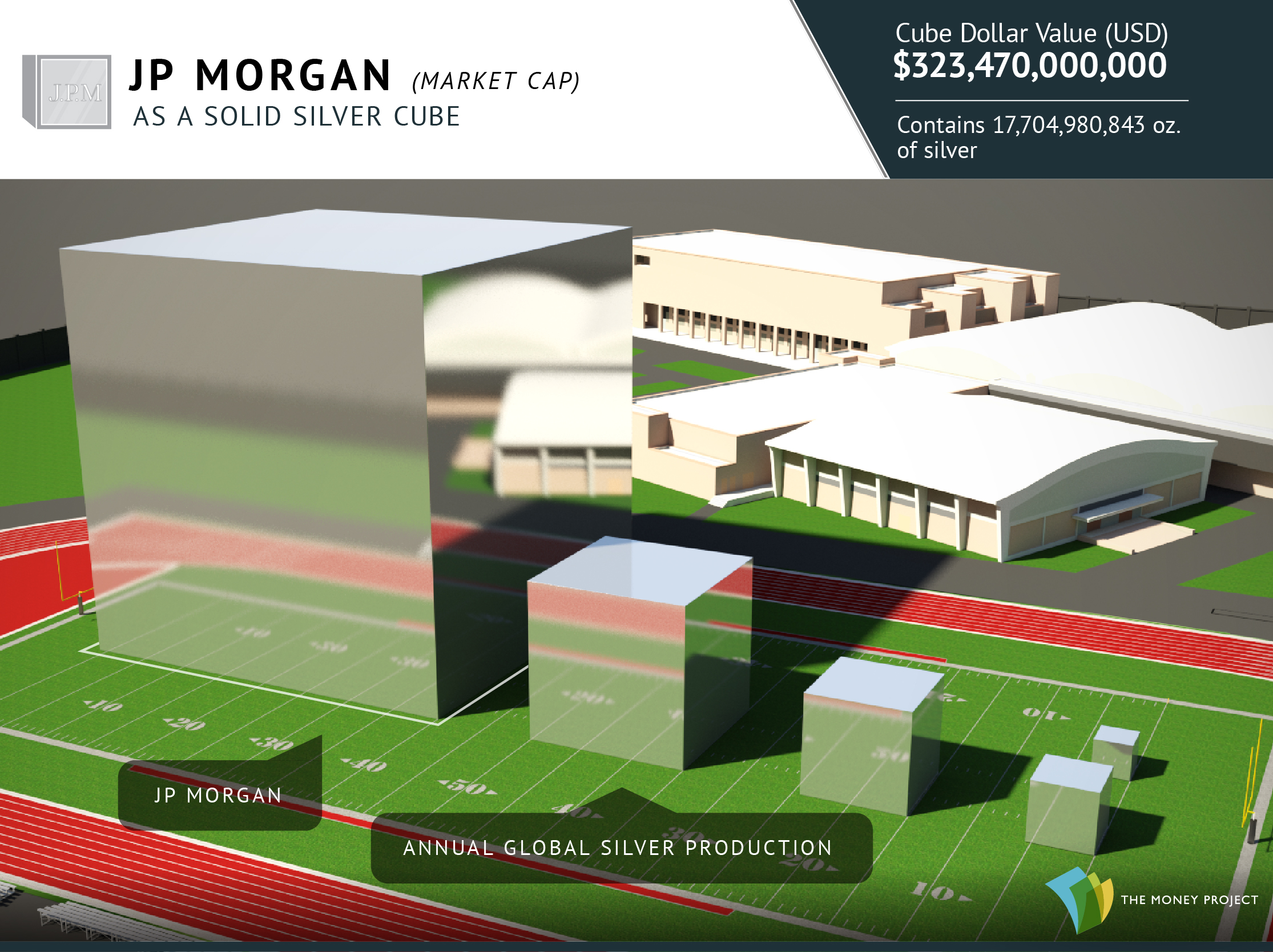

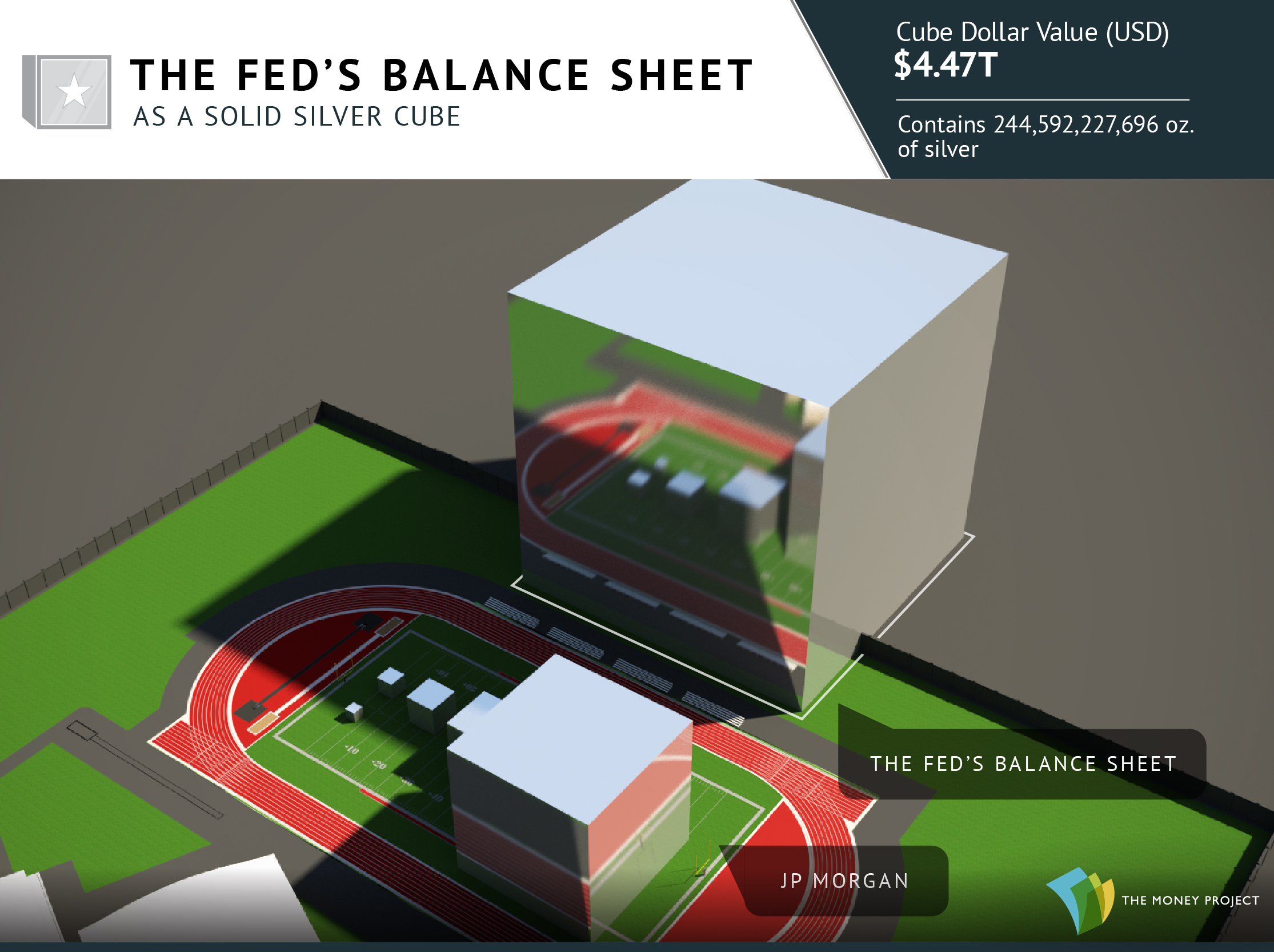

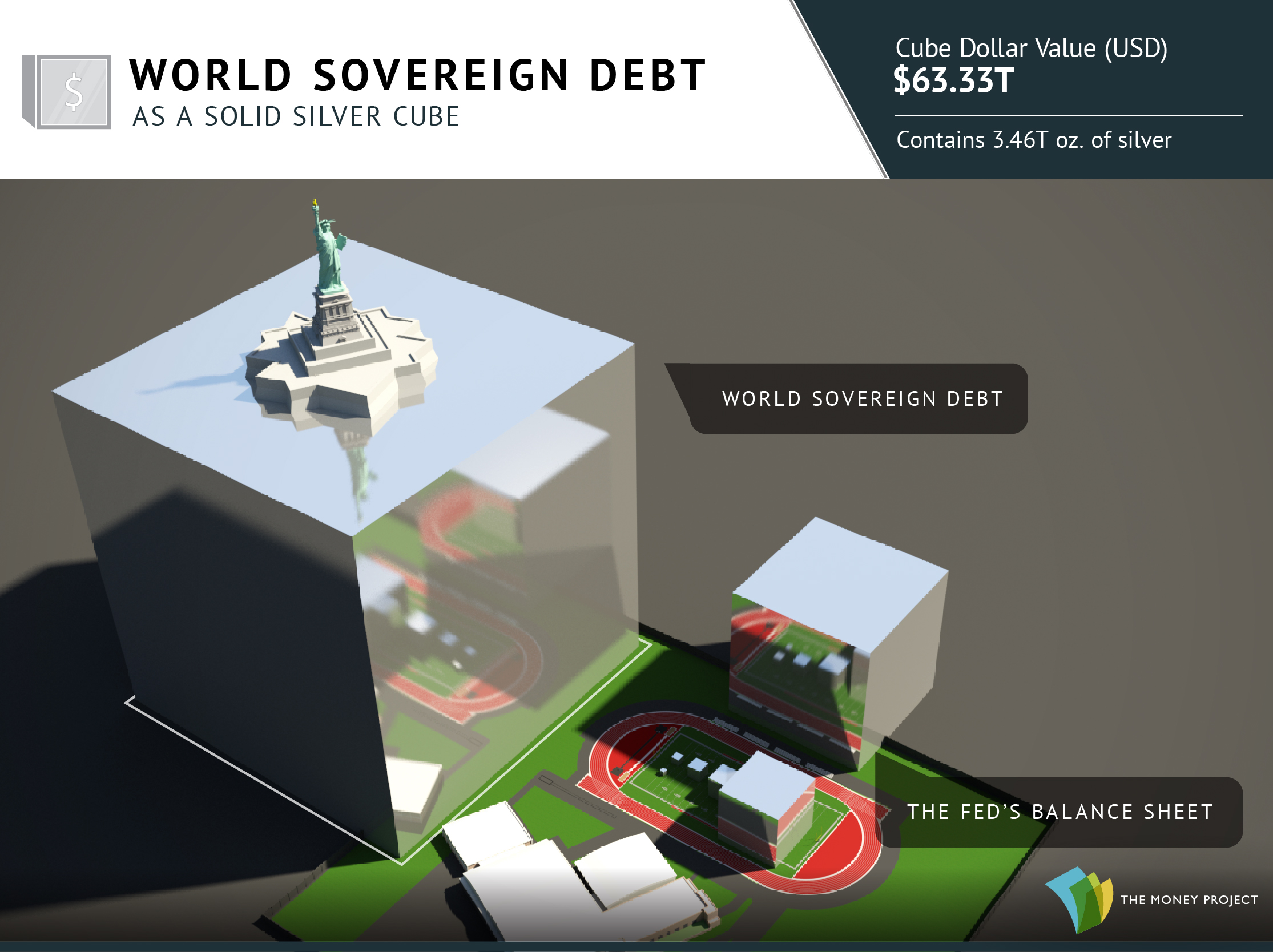

That’s why visualizing things spatially can give us a better perspective on money and markets.

How Much Money Exists?

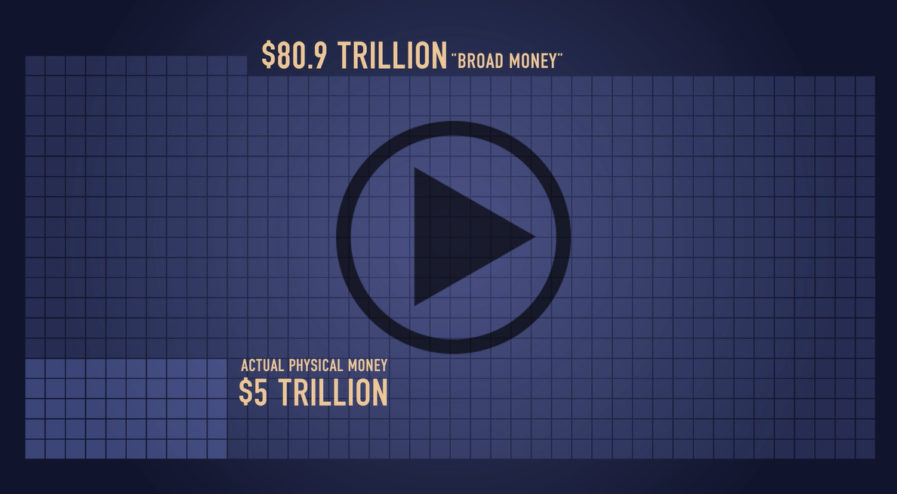

This infographic was initially created to show how much money exists in its different forms. For example, to highlight how much physical cash there is in comparison to broader measures of money which include saving and checking account deposits.

Interestingly, what is considered “money” depends on who you are asking.

Are the abstractions created by Central Banks really money? What about gold, bitcoins, or other hard assets?

A New Meaning

However, since we first released this infographic in 2015, “All the World’s Money and Markets” has taken on a different meaning to us and many others. It’s a way of simplifying a complex universe of currencies, assets, and other financial instruments in a way that people can understand.

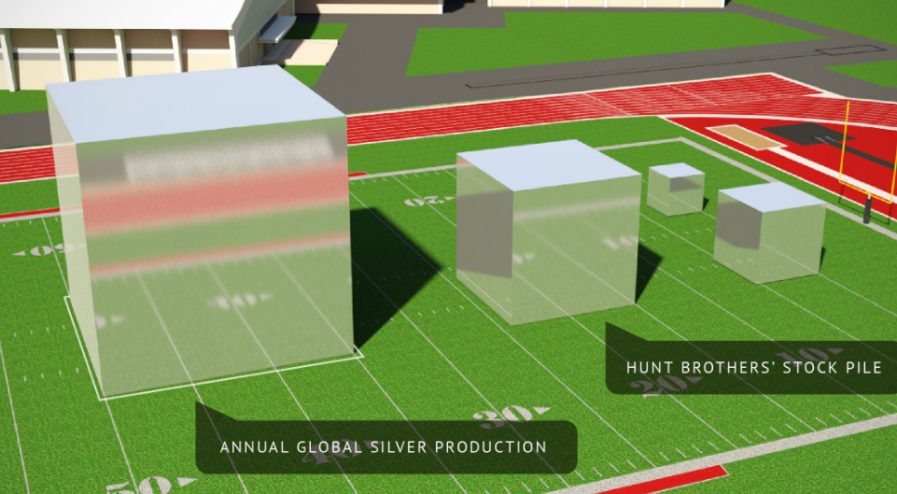

Numbers represented in the data visualization range from the size of the above-ground silver market ($17 billion) to the notional value of all derivatives ($1.2 quadrillion as a high-end estimate). In between those two extremes, we’ve added many other familiar measures, such as the GDP of California, the value of equities, the real estate market, along with different money supply metrics to give perspective.

The end result? A visually pleasing, but enlightening new way to understand the vast universe of global assets.

To get “All the World’s Money” in book or poster form, go to the Kickstarter page now. Deadline: Oct. 31, 2017

About the Money Project

The Money Project uses intuitive visualizations to explore ideas around the very concept of money itself. Founded in 2015 by Visual Capitalist and Texas Precious Metals, the Money Project will look at the evolving nature of money, and will try to answer the difficult questions that prevent us from truly understanding the role that money plays in finance, investments, and accumulating wealth.

Embed This Image On Your Site (copy code below):