The Money Project is an ongoing collaboration between Visual Capitalist and Texas Precious Metals that seeks to use intuitive visualizations to explore the origins, nature, and use of money.

Only a few days after Trump’s inauguration ceremony, the U.S. National Debt will creep across the important psychological barrier of $20 trillion.

It’s a problem that’s been passed down to him, but it certainly puts the incoming administration in a difficult place. The debt is burdensome by pretty much any metric, and the rate of borrowing has exceeded economic growth pretty much since the late 1970s.

How Trump deals with this escalating constraint will be a deciding factor in whether his administration crashes and burns – or ends up re-positioning America for greatness.

Donald Trump’s $20 Trillion Problem

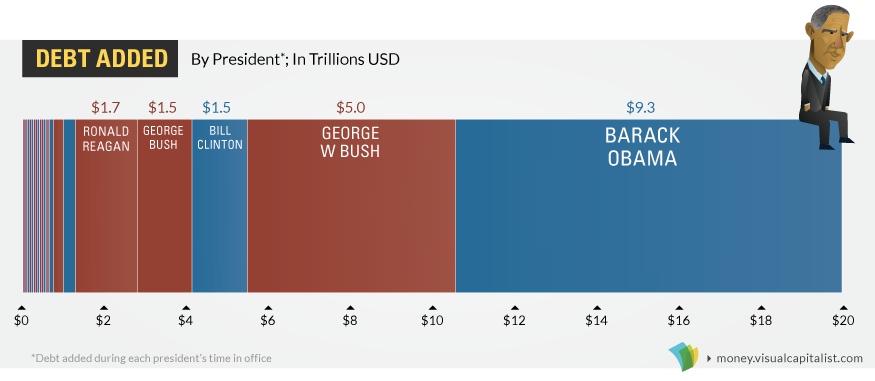

Partisans will squabble about who added what to the mounting debt, but the reality is that none of that really matters. Both parties have kicked the can down the road for the last 40 years, and that has culminated in the current situation:

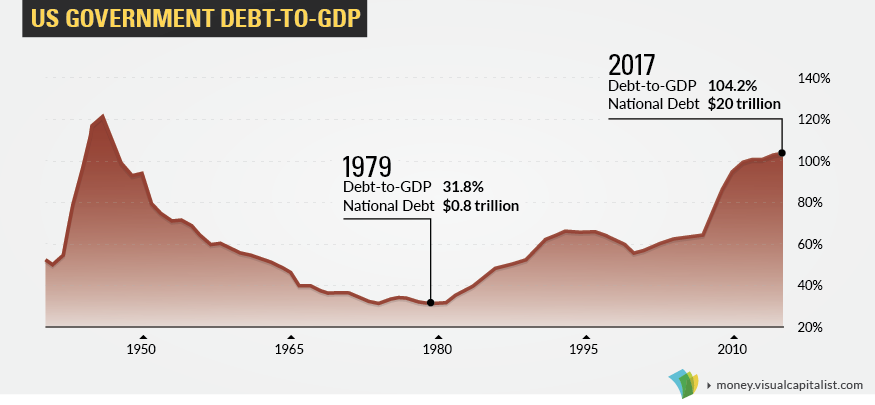

Back in 1979, the debt-to-GDP ratio was a modest 31.8%, and the federal government only had an outstanding tab of $826 billion. Fast forward to today, and the perpetual borrowing has added up.

The debt-to-GDP is now 104.2%, with the total debt burden nearing the $20 trillion mark.

In absolute terms, the debt is the highest it has ever been. Using the common measure of debt-to-GDP, the debt is the highest it’s been in 70 years. The last time it soared past the 100% mark was during the final year of WWII.

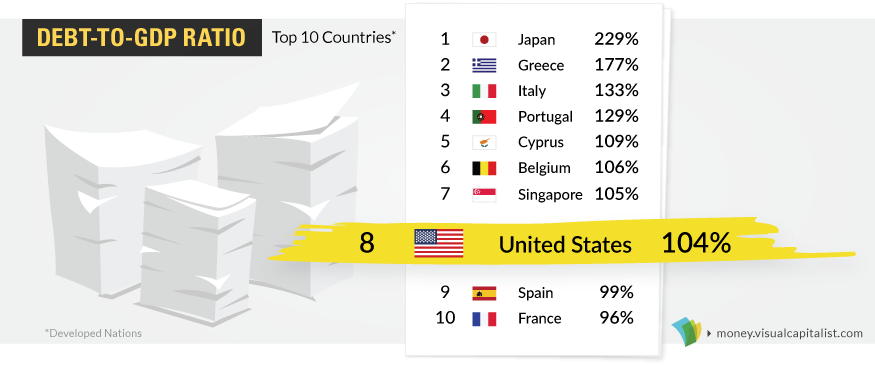

Granted, the situation isn’t as bad as Greece, Cyprus, or Japan – but it’s getting there:

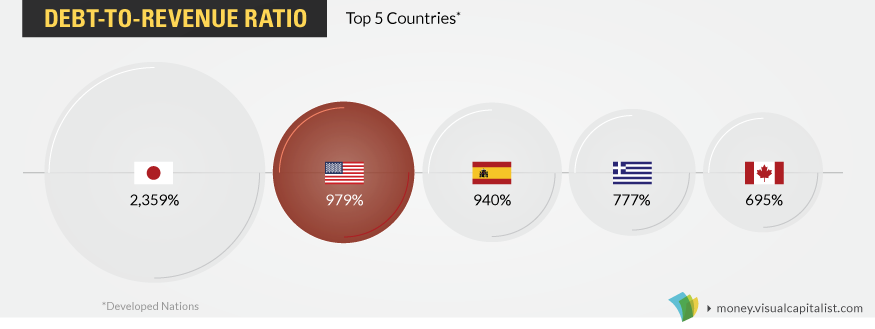

In terms of debt-to-revenue, a measure that compares the national debt to the amount of taxes taken in by the federal government, the U.S. has the 2nd highest debt out of 34 OECD countries:

On a “per person” basis, each person in the U.S. owes $61,300 – the second highest in the world. Per taxpayer, however, that amount balloons to $167,000.

Changing Rhetoric

So what does Trump think of all this debt business? It’s hard to say, because his rhetoric has changed.

At the start of his campaign, he made it clear that debt would be a top issue for his administration. In February 2016, Trump said that the U.S. was becoming a “large-scale version of Greece” and that tackling the debt would be “easy” with a more dynamic economy. In April 2016, he said he could pay off the debt after eight years in office.

This rhetoric aligns with the official GOP platform, which says that the national debt has “placed a significant burden on future generations”, calling for a “strong economy” and “spending restraint” to pay it down.

But since then, Trump’s views may have changed.

His most recent economic plans include $1 trillion in infrastructure and $5 trillion in tax cuts – and they could increase debt by anywhere from $5.3 to $11.5 trillion. He’s also said that the U.S. will never have to default because it can simply “print money”.

How Trump will choose to deal with the debt is a big question – and only time will tell if his actions will make America great again.

About the Money Project

The Money Project aims to use intuitive visualizations to explore ideas around the very concept of money itself. Founded in 2015 by Visual Capitalist and Texas Precious Metals, the Money Project will look at the evolving nature of money, and will try to answer the difficult questions that prevent us from truly understanding the role that money plays in finance, investments, and accumulating wealth.