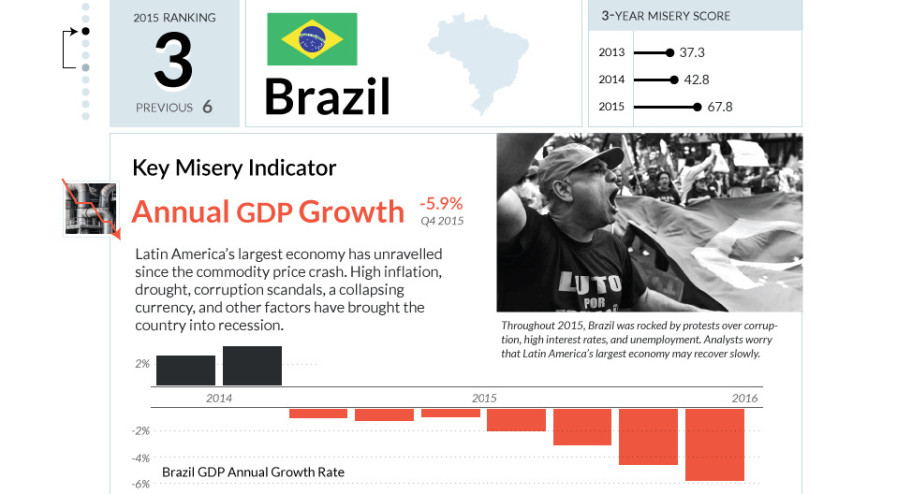

Visualizing the Most Miserable Countries in the World

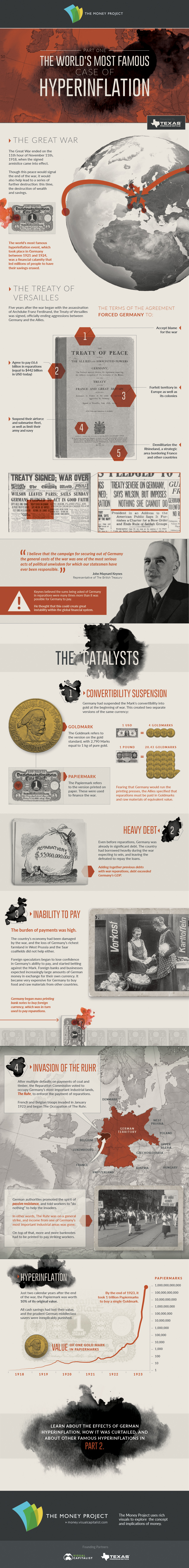

The Money Project is an ongoing collaboration between Visual Capitalist and Texas Precious Metals that seeks to use intuitive visualizations to explore the origins, nature, and use of money.

Every year, the Cato Institute publishes a list of the world’s most “miserable countries” by using a simple economic formula to calculate the scores. Described as a Misery Index, the tally for each country can be found by adding the unemployment rate, inflation, and lending rate together, and then subtracting the change in real GDP per capita.

Disaster in Venezuela

According to the think tank, countries with misery scores over 20 are “ripe for reform”. If that’s true, then socialist Venezuela is way overdue.

The troubled nation finished with a misery score of 214.9, the highest marker in 2015 by far. Unfortunately, the number is not looking better for this year, as the IMF has projected that hyperinflation will top 720% by the end of 2016. For the average Venezuelan, that means that food staples and other necessities will be doubling in price every four months.

Hyperinflation has taken its toll on citizens already. Three years ago, one US dollar could buy four Venezuelan bolivars. Today, one dollar can buy more than 1,000 bolivars on the black market. If the inflation rate keeps accelerating, the situation could approach a similar trajectory to hyperinflation in Weimar Germany, where rates eventually catapulted to one trillion percent after six years.

While hyperinflation is certainly one of Venezuela’s biggest concerns, the nation has also been short on luck lately. The Zika virus has hit the country hard, and the oil crash has created political, economic, and social tensions in a nation that depends on oil exports to balance the budget. Three in four Venezuelans have fallen into poverty, and the country’s GDP is expected to contract 8% in 2016.

Venezuelans are now facing dire shortages for many necessities, including power. Droughts have caused mayhem on the country’s hydro reservoirs, making blackouts common and widespread. Food, medical supplies, and toilet paper are in short supply, and even beer production has been shut down.

Key Stats:

- Approval Rating of Nicolas Maduro: 26.8%

- People in poverty: 76%

- Oil exports, as a percent of total revenue: 96%

- Homicides per capita: 2nd highest in world

- Good shortages: Power, medical supplies, food, toilet paper, beer

- Fiscal deficit: 20% of GDP

Recent measures taken to dampen the crisis in Venezuela have been bold.

The government has moved entire time zones while reducing the work week of public sector workers to try and work around power deficiencies. Meanwhile, minimum wage earners have been given a 30% raise to keep up with inflation.

However, the crisis may be coming to a head. A recent survey shows that 87% of Venezuelans do not have enough money to purchase enough food to meet their needs, and people are getting restless.

In early May, the opposition party submitted a list 1.85 million signatures to the electoral commission to seek a recall referendum against President Nicolas Maduro. Days after the submission, the leader of an opposition party was found dead after being shot in the head.

Unless the country gets ruled with an iron fist, the level of misery can only reach a certain point before the people take decisive action.

About the Money Project

The Money Project aims to use intuitive visualizations to explore ideas around the very concept of money itself. Founded in 2015 by Visual Capitalist and Texas Precious Metals, the Money Project will look at the evolving nature of money, and will try to answer the difficult questions that prevent us from truly understanding the role that money plays in finance, investments, and accumulating wealth.

Embed This Image On Your Site (copy code below):